boulder co sales tax 2020

The city of boulder will no longer mail returns after jan. July 2020 sales tax declined by 730016 or 81 when compared to July 2019.

Should Boulder Do Away With Sales Tax On Groceries Boulder Beat

The December 2020 total local sales tax rate was also 4985.

. Boulder County does not issue licenses for sales tax as the county sales tax is collected by the Colorado Department of Revenue CDOR. The County sales tax rate is. Ad Find Out Sales Tax Rates For Free.

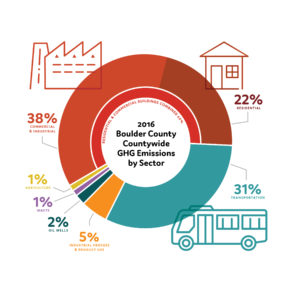

The esd tax is on top of the city of boulder sales tax rate of 386. The Colorado Department of Revenue is responsible for publishing the. The Boulder Colorado sales tax is 885 consisting of 290 Colorado state sales tax and 595 Boulder local sales taxesThe local sales tax consists of a 099 county sales tax a 386 city sales tax and a 110 special district sales tax used to fund transportation districts local attractions etc.

CBS4 Beginning Wednesday all vaping products sold in Boulder will be subject to an additional city sales and use tax of 40Its part of an effort to curb use among young. Sales tax is due on all retail transactions in addition to any applicable city and state taxes. The Boulder Sales Tax is collected by the merchant on all qualifying sales.

The 80303 boulder colorado general sales tax rate is 8845. The minimum combined 2022 sales tax rate for Boulder Colorado is. The Colorado sales tax rate is currently.

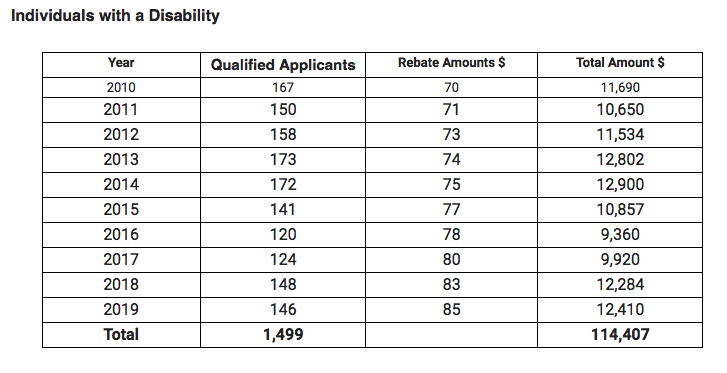

Saturday May 2 2020. There is no applicable city tax. 202 038 sales tax extension for general fund Passed 7164 to 2836 2009 2A 015 sales and use tax extension for the general fund Passed 6804 to 3196.

You can print a 9 sales tax table here. Salestaxbouldercoloradogov o llamarnos a 303-441-4425. Boulder County CO Sales Tax Rate The current total local sales tax rate in Boulder County CO is 4985.

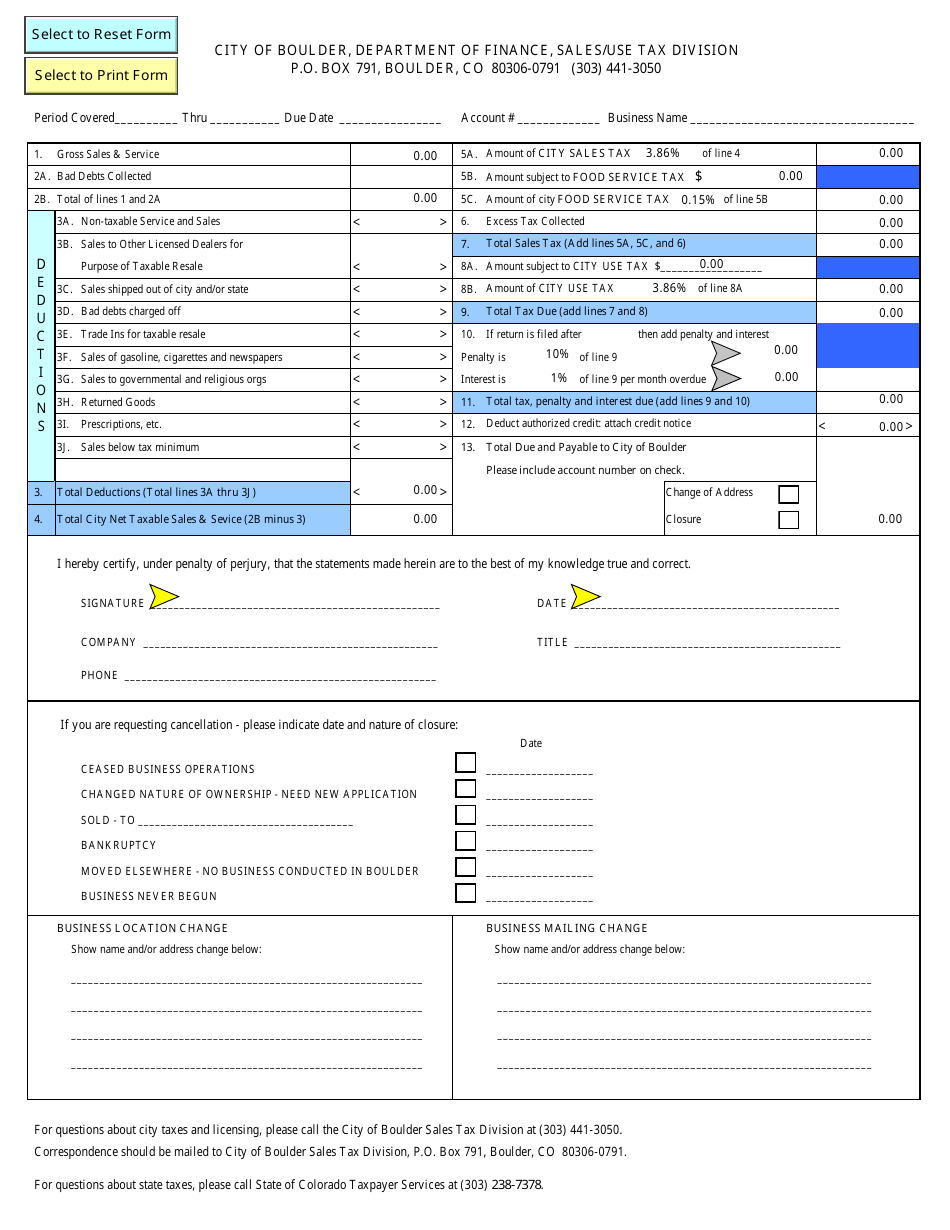

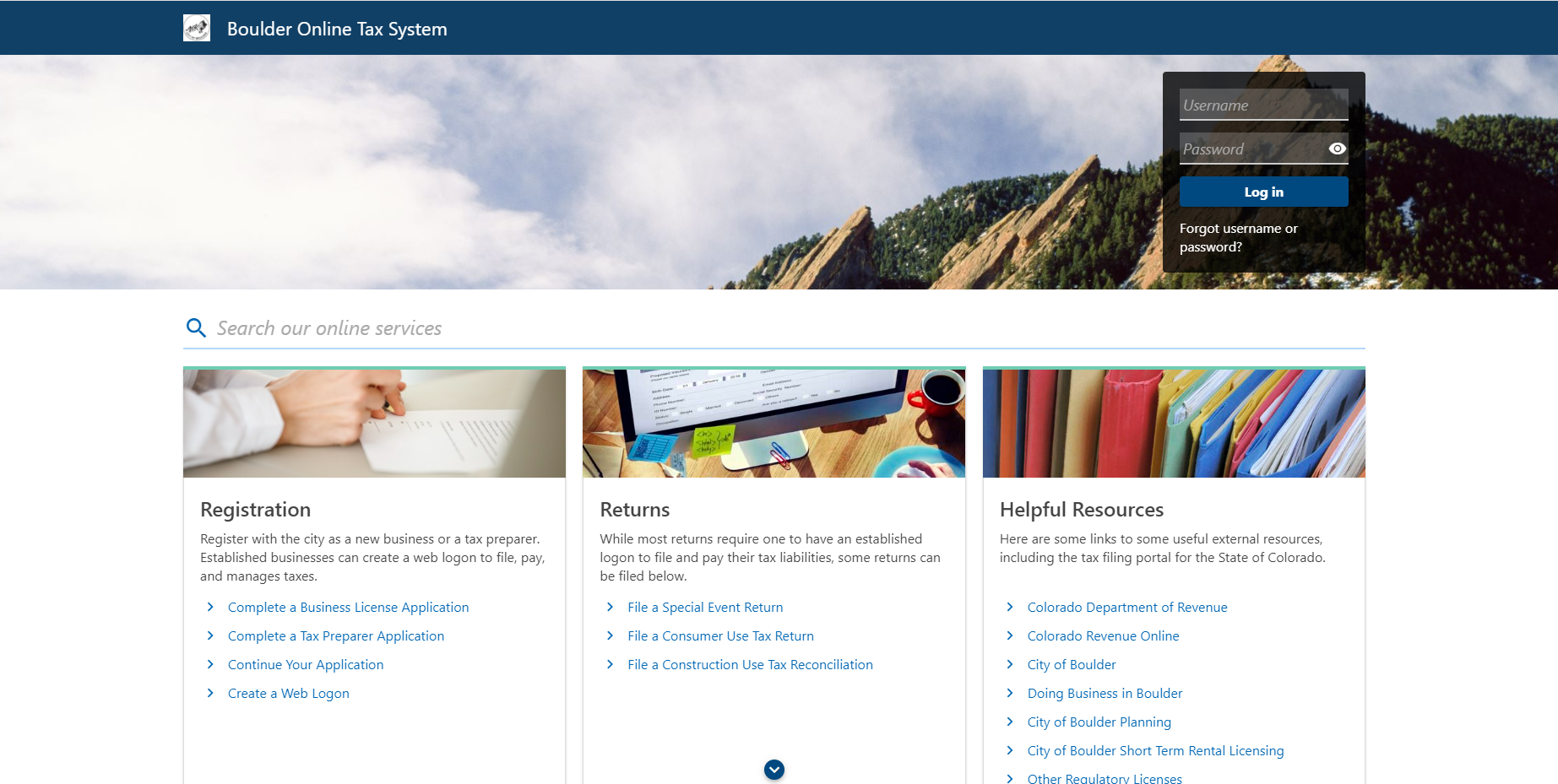

The citys Sales Use Tax team manages business licensing sales tax use and other tax filings construction use tax reconciliation returns and various tax auditing functions. About City of Boulders Sales and Use Tax. Para asistencia en español favor de mandarnos un email a.

This is an improvement over June 2020 which declined by 126 compared to June 2019. The sales tax jurisdiction name is Santa Cruz County Tourism Marketing District which may refer to a local government division. 2055 lower than the maximum sales tax in CO.

Including audit revenue total sales and use tax increased from 2020 by 1657565 or 1829. Taxes on Boulders ballot 2008-2020. For tax rates in other cities see Colorado sales taxes by city and county.

The Boulder sales tax rate is. Fast Easy Tax Solutions. The current total local sales tax rate in Boulder CO is 4985.

The 2020 Boulder County sales and use tax rate is 0985. CO Sales Tax Rate. Boulder co sales tax rate.

The City of Lovelands sales tax rate is 30 combined with Larimer Counties 080 sales tax rate and the State of Colorados 29 sales tax rate the overall total is 670. Sales and Use Tax Year to date YTD sales and use tax based upon current economic activity decreased from 2019 by 781938 or 790. This is the total of state county and city sales tax rates.

Businesses located in the Centerra Fee districts sales tax rate is 175 and is in addition to the district fees. The December 2020 total local sales tax rate was 8845. How to Apply for a Sales and Use Tax License.

The 9 sales tax rate in Boulder Creek consists of 6 California state sales tax 025 Santa Cruz County sales tax and 275 Special tax. The rate is comprised of individual voterapproved county sales and use tax ballot measures adopted to support county programs in conservaon transportaon offe nder management nonprofit capital. 201 City retention of property tax funds Passed 6499 to 3501 Issue No.

December activity reflects severe public health restrictions after Boulder County moved to Level Red on November 20. This is the total of state county and city sales tax rates. LID sales tax is remitted in the cityLID column on the DR 0100 Retail Sales Tax Return Use tax is not applicable.

Boulder County 0985 TOTAL Combined Sales Tax Rate in Longmont. Longmont Sales Tax Division 350 Kimbark St Longmont CO 80501. Boulder county cip - 2007 sales tax current phasing plan current roadshoulder safety projects estimated timeline projects requiring action by project partner projects requiring planning pre-engineering draft boulder county transportation march 2020 - draft page 1 of 2.

The effects of closures can still be seen across most industries which saw sales and use tax declines or were flat compared to YTD July 2019. 2055 lower than the maximum sales tax in co. The 8845 sales tax rate in Boulder consists of 29 Colorado state sales tax 0985 Boulder County sales tax 386 Boulder tax and 11 Special tax.

LID Boundaries Sales Tax Rate Service Fee Allowed Boulder County Old Town Niwot and Cottonwood Square 1 0. Boulder countys sales tax rate is 0985 for 2020 sales tax is due on all retail transactions in addition to any applicable city and state taxes. YTD December 2020 sales tax including audit revenue declined by 9458832 or 833 when compared to YTD December 2019.

You can print a 8845 sales tax table here. On a rolling 12-Month basis total sales and use tax based upon current economic activity declined by 071. There is no applicable city tax.

Boulder Countys Sales Tax Rate is 0985 for 2020. Exemptions areTelephone and telegraph service gas and electricity for residential and commercial use. The Colorado State Tax Tables for 2020 displayed on this page are provided in support of the 2020 US Tax Calculator and the dedicated 2020 Colorado State Tax CalculatorWe also provide State Tax Tables for each US State with supporting tax calculators and finance calculators tailored for each state.

This weeks city council budget discussion painted a dark picture of Boulders potential future finances as COVID-19 closures wreak havoc on businesses with a 41 million drop in revenue below what was planned for 2020 and a 21 million smaller general fund from which to pay for police fire libraries and. Return the completed form in person 8-5 M-F or by mail. Through January 2020 and is largely attributed to economic activity through the month of January 2020.

Moving To Boulder Boulder Co Relocation Homebuyer Guide

Chevy Colorado Bed Rack Egr 2 Fender Flares 2015 2016 Colorado Chevy Colorado Gmc Chevy Colorado Chevy Colorado Z71 2015 Chevy Colorado

10402 Manly Chapel Hill Nc 27517 Photo 7 Of 29 Chapel Hill House Design Chapel

City Of Boulder Colorado Sales Use Tax Return Form Download Fillable Pdf Templateroller

Taxes In Boulder The State Of Colorado

Construction Use Tax City Of Boulder

Sales And Use Tax City Of Boulder

Summerlin A Master Planned Community In Las Vegas Nv Amenities Maps Community Master Planned Community How To Plan Map

733 Lakeshore Dr Boulder Co 80302 4 Beds 2 5 Baths House Inspiration Home Bouldering

2515 Boulder Rd Altadena Ca 91001 Mls P1 4307 Redfin Bouldering House Styles Exterior

Innovation Technology City Of Boulder

Sales Tax Revenue In Colorado Cities Since Start Of The Pandemic Common Sense Institute

Boulder Exploring New Taxes Fees As Revenues Falter Boulder Beat

Cience Debuts At 31 In The Financial Times Americas Fastest Growing Companies 2020 Send2press Newswire Financial Times How To Start Conversations Financial

Http Www Boulder Homes For Sale Com Dream Pools Luxury Swimming Pools Indoor Outdoor Pool